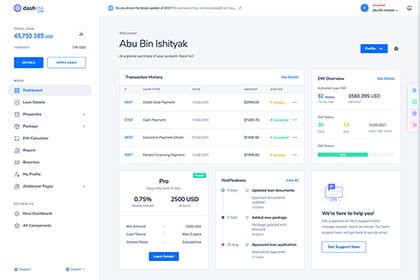

Package Documents

You can apply for this loan right now if you meet the following criteria:

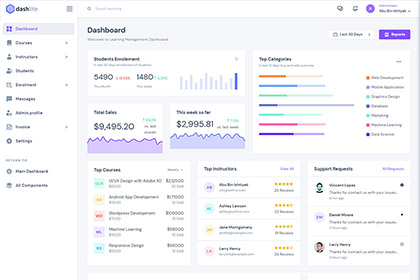

Education

- Minimum age of the applicant should be 20years and maximum 35 years.

- Need Higher National Certificate (HNC) or Higher National Diploma (HND).

- Scoring high grades/ranking in the qualifying exams.

- Displaying good prospects for future employment/income generation.

- Strong financial background of parents/guardians/co-borrower.

Service Holder

- Minimum age of the applicant should be 21years and maximum 65 years.

- Govt. and permanent salaried employees with a minimum income of 400 USD per month are eligible for loan

- At least 6 months experience in their current job with a total experience of 3 years

- CIBIL score should be 700 or more than that with a good credit history which is equally important to get approvalon loan application

- The borrower must be creditworthy or have a creditworthy cosigner

- Creditworthiness can be measured using credit scores, annual income, debt-to-income ratios and employment history.

- The minimum legal age of a private student loan borrower may depend on the state of residence. The age of majority is 21years

- Eligibility also can depend on a degree, academic major or participating school.

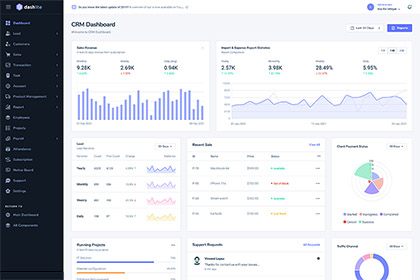

Bussinessman

- Age should be greater than 21 years and less than 65 years on liquidation of the loan

- The business should be operational for a minimum continuous period of 6 months

- The quarterly turnover should be higher than 1500 USD

- The business activity should not be in the negative list, and the location of the business should not be in a restricted site.

- Operate for profit

- Be engaged in, or propose to do business

- Have reasonable owner equity to invest

- Use alternative financial resources, including personal assets, before seeking financial assistance.

Under Privileged People

- Minimum age of the applicant should be 15years and maximum 65 years.

- Have reasonable owner equity to invest

- Use alternative financial resources, including personal assets, before seeking financial assistance.

- The borrower must be creditworthy or have a creditworthy cosigner

Quota (Special)

- Age should be greater than 21 years and less than 60 years on liquidation of the loan

- The patriot should be operational for a minimum continuous period of 1 year

- The patriot should be citizen of this country

- Loans have long terms, ranging from 10 to 25 years, and affordable interest-rates.

- Age should be greater than 40 years and less than 75 years on liquidation of the loan

- The person should be citizen of this country

- Loans have long terms, ranging from 15 to 25 years, and affordable interest-rates.

- To avail is this aged loan, he should be minimum earning income 500 USD .

- The borrower should be citizen with a minimum of 40% disability.

- The applicant should be aged between 18 years and 55 years

- The annual income of the applicant should be at least 500 USD in urban areas and 400 USD in rural areas.

- The applicants should preferably be frequent members of self-help groups such as Thrift and Credit Group.

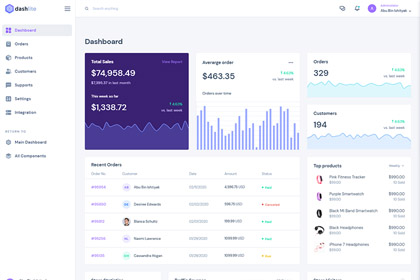

Our service is designed to support your various needs including:

- Home improvement / renovation

- Meeting financial liabilities

- Sole proprietorship or limited liabilities

- Domestic or foreign travel

- Medical treatment for self/family members

- Special Quota like superpatriot, aged & disable people

- Purchase of consumer durables

- Education

- Other needs

Edication

- Copies of National ID Card & TIN of Borrower, Student and Guarantor (if available)

- Fully Completed and Signed Application Form

- Salary/ Income Certificate stating net earning

- Copy of Passport with valid visa of the student

- Academic Documents of Student

Service Holder

- Photocopy of NID/Smart card of Loan applicant and guarantor

- 3 copies of Passport size lab print photograph of Loan applicant and 2 copies of guarantor

- Visiting Card/Business card/Office ID copy of both loan applicant and guarantor

- Latest E-TIN of customer

- Sanction letter and repayment statement of existing loans (if any)

Bussiness Loan

- Photocopy of NID/Smart/passport/driving lisence or any other valid documents form government

- 3 copies of Passport size lab print photograph of Loan applicant and 2 copies of guarantor

- Bank account statements

- Registration documents or tax payment receipt

- Shop registration certificate